-

-

-

PRODUCT

-

- PRODUCTS

-

-

2Sell

Accept mobile and online payments from buyers worldwide

2Sell

Accept mobile and online payments from buyers worldwide

-

2Subscribe

Subscription management solution to maximize recurring revenue

2Subscribe

Subscription management solution to maximize recurring revenue

-

2Monetize

Full commerce solution built for digital goods sales

2Monetize

Full commerce solution built for digital goods sales

-

Add-ons

Additional services to boost online sales

Add-ons

Additional services to boost online sales

-

-

- SOLUTIONS

- CLIENTS

- COMPANY

- PRICING

-

-

-

Resources

-

- REVENUE UPLIFT CALCULATOR

-

-

See the potential revenue uplift you could gain by selling online with 2Checkout.

-

- Support

- Partners

-

-

-

Login

Login

-

Login

Login

- TALK TO SALES

- TALK TO SALES

- SIGN UP for FREE

-

Resources

Payment Fraud Management to Scale Globally, Risk-Free

Payment Fraud Management and International Compliance is Not Something

Your Team Needs to Worry About

When selling internationally, payment fraud management and compliance with international regulations are big issues. The good news is that

we take care of both, so you can concentrate on growing your business.

we take care of both, so you can concentrate on growing your business.

We Protect You Against Payment Fraud

Your security is paramount in everything we do. Our services go above and beyond to protect you and your customers from

fraudulent activity. We provide security that saves you from worrying about payment fraud and theft.

fraudulent activity. We provide security that saves you from worrying about payment fraud and theft.

Upgraded Fraud Detection Tools

We offer a multi-tier defense strategy to identify fraudulent activity and keep it from impacting your operations. Our algorithms are proprietary to our business and customized to different industries and geographies. We use a combination of artificial intelligence and manual review processes to make sure our fraud-detection mechanisms are optimized, keeping fraud to a minimum.

Crushing False Positives

These same anti-fraud mechanisms also ensure as little interference as possible with good orders, as unnecessary fraud alerts can negatively affect your authorization and conversion rates, bottom line, and customer satisfaction.

Reliable Global Commerce. The Highest Level of Compliance

PCI DSS

PSD2

GDPR

SSAE 18

The Payment Card Industry Data Security Standard was developed to protect consumers and their data no matter where they shop or what channel they use. 2Checkout is PCI Level 1 certified, the highest level of certification possible. Our redundant data centers store and encrypt credit card numbers for you, so you can focus on your business and not on managing credit card security.

The 2nd Payment Services Directive (PSD2) is the revised regulatory framework for payment services, initiated by the European Commission. Presented as a catalyst for innovation in the financial industry, PSD2 comes with changes and a new set of consequences not only for payment services providers, neo-banks, or fintech companies, but also for digital merchants that are selling any type of product.

Our customers' right to privacy is a main priority for 2Checkout. Our focus is to process payments securely and efficiently, while also adhering to the latest privacy regulations, including GDPR for the European Union. We are committed to transparency, control, and accountability.

2Checkout is also ISAE 3402 and SSAE 18 compliant - these are the highest standards that address reporting on controls at a service organization.

PCI DSS

REPER

The Payment Card Industry Data Security Standard was developed to protect consumers and their data no matter where they shop or what channel they use. 2Checkout is PCI Level 1 certified, the highest level of certification possible. Our redundant data centers store and encrypt credit card numbers for you, so you can focus on your business and not on managing credit card security.

PSD2

REPER

The 2nd Payment Services Directive (PSD2) is the revised regulatory framework for payment services, initiated by the European Commission. Presented as a catalyst for innovation in the financial industry, PSD2 comes with changes and a new set of consequences not only for payment services providers, neo-banks, or fintech companies, but also for digital merchants that are selling any type of product.

GDPR

REPER

Our customers' right to privacy is a main priority for 2Checkout. Our focus is to process payments securely and efficiently, while also adhering to the latest privacy regulations, including GDPR for the European Union. We are committed to transparency, control, and accountability.

SSAE 18

REPER

2Checkout is also ISAE 3402 and SSAE 18 compliant - these are the highest standards that address reporting on controls at a service organization.

REPER

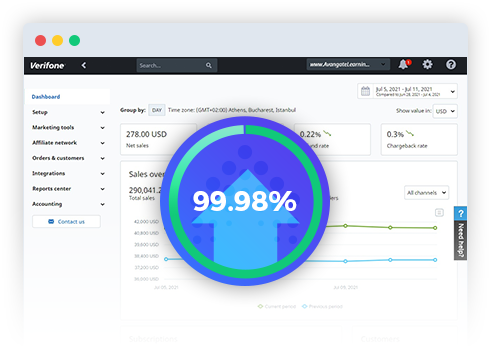

Outstanding Uptime

Our comprehensive disaster recovery and failover plan guarantees an average of 99.98%+ uptime. For performance and availability monitoring, we employ a global monitoring system from multiple sites across continents.